When buying a condo or townhome, many homeowners are drawn to the convenience and low-maintenance lifestyle of a property managed by a Homeowners Association (HOA). One major perk often touted is the “master insurance policy,” which covers damage to common areas and the building’s exterior. However, many owners are unaware of a lurking financial risk: special assessments resulting from insurance claims.

Let’s explore what this means—and how to protect yourself.

What Is a Master Insurance Policy?

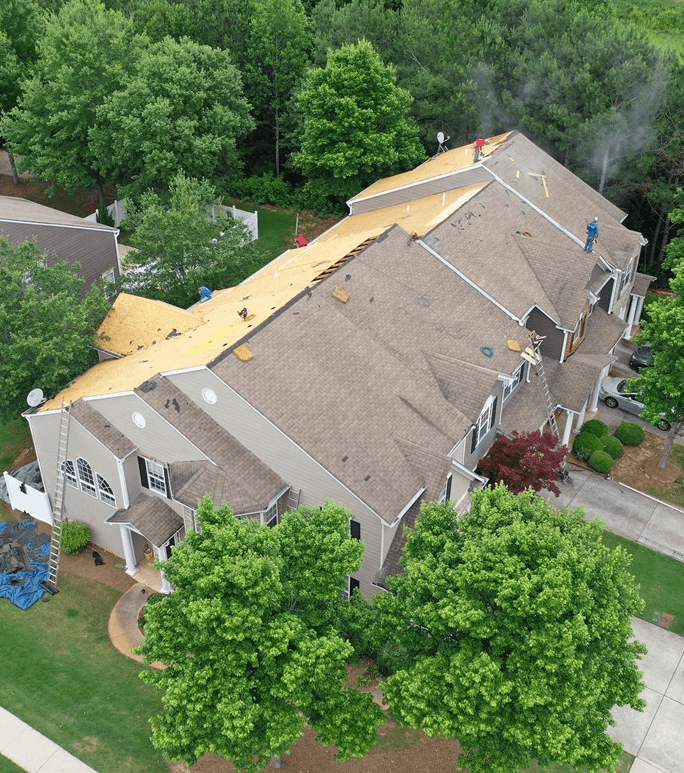

A master insurance policy is carried by the HOA and typically insures the structure of the building and shared spaces—such as roofs, walls, elevators, hallways, pools, and clubhouses. When a loss occurs—say a fire, hailstorm, or plumbing leak—the HOA files a claim with their insurer, not the individual unit owners.

Sounds great, right? But there’s a catch.

When Claims Trigger Special Assessments

HOAs often carry high deductibles on their master policies—sometimes $25,000, $50,000, or even more. Why? To keep premiums affordable.

If the damage from a covered loss doesn’t exceed the deductible or only barely does, the HOA might not file a claim at all. Instead, they’ll pass the cost on to homeowners in the form of a special assessment. Even if a claim is made, the deductible itself can be assessed to the homeowners.

This means you could be on the hook for thousands of dollars—just because a neighbor’s bathroom flooded or a tree fell on the clubhouse.

Examples of How This Happens

- Wind/Hail Damage: After a storm damages several roofs in a townhome community, the HOA decides not to file a claim because the total cost is $60,000—but the deductible is $50,000. Instead, each of the 20 homeowners receives a $3,000 bill.

- Fire Damage in One Unit: A fire starts in a single unit, and the claim triggers a $25,000 deductible. Rather than placing the full burden on one unit owner, the HOA spreads the deductible equally across all units.

- Sewer Backup in Shared Plumbing Line: The master policy doesn’t cover sewer backup, or coverage is limited. Homeowners split the full repair cost as an assessment.

How to Protect Yourself

- Understand Your HOA’s Policy Deductible: Ask the HOA for a copy of the master policy and its declarations page. Look at the deductible amounts—especially for wind/hail or water damage.

- Review Governing Documents: Check your community’s bylaws or CC&Rs. These outline whether and how deductibles or repairs can be assessed to unit owners.

- Consider Loss Assessment Coverage: Many condo and townhome insurance policies (HO-6) offer Loss Assessment Coverage—which can pay your share of an HOA assessment due to a covered claim. Be sure to check your limit—$1,000 may not be enough.

- Talk to an Insurance Agent: Work with an agent who understands HOA structures and master policies. They can recommend adequate loss assessment limits and help ensure your personal policy doesn’t have gaps.

Final Thoughts

HOA living offers many conveniences, but it also comes with shared financial responsibilities. When a master policy claim is made—or not made—you might feel the effects directly in your wallet. Don’t be caught off guard. Understanding how your HOA handles insurance claims and assessments is critical to protecting your finances and your peace of mind.

Need help reviewing your coverage or policy options? Reach out to a licensed insurance advisor who specializes in HO-6 policies and HOA communities. A small change in your coverage today could prevent a large unexpected bill later.

Comments are closed.